Governor: BB to release new banknotes before Eid

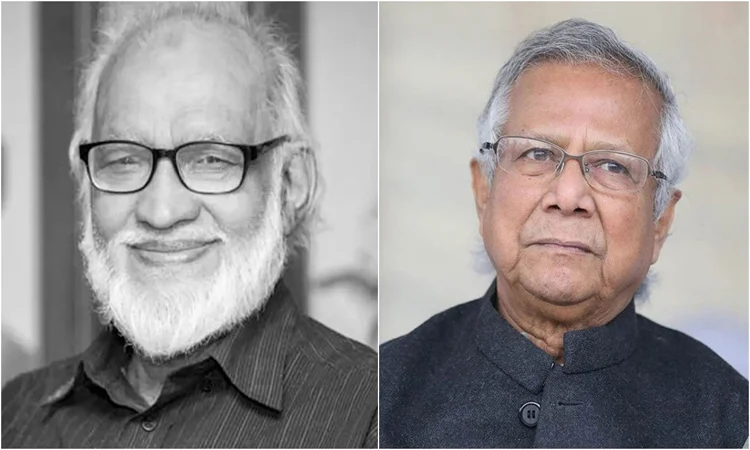

Dhaka: Bangladesh Bank (BB) Governor Ahsan H Mansur on Saturday announced that the government is set to introduce new currency notes ahead of Eid-ul-Azha, with designs emphasizing national heritage rather than portraits.

The BB governor made the comment while speaking as the chief guest at the inauguration ceremony of the "Credit Enhancement Scheme (CEC)," organized by the Palli Karma-Sahayak Foundation (PKSF) at the PKSF auditorium in the city.

"New Tk1,000, Tk50, and Tk20 banknotes will be released into circulation before Eid-ul-Azha. The notes will not feature any human portraits but will instead showcase natural landscapes and traditional landmarks of Bangladesh," Mansur said.

PKSF Chairman Zakir Ahmed Khan presided over the event, while Asian Development Bank (ADB) Country Director Hoe Yun Jeong and Financial Institutions Division Secretary Nazma Mobarek were present as special guests.

In response to a question from journalists after the ceremony, Mansur said the new banknotes that the government will release ahead of Eid-ul-Azha will feature images of mosques, temples, historical landmarks, and natural sceneries, without any human portraits.

"People will get to see these new notes ahead of Eid-ul-Azha. These notes will not have images of any person printed on them," he added.

When asked about the types of monuments that would appear on the notes, the BB governor said: "Some historically significant monuments will be printed on these notes, be it a mosque or a temple. We are not differentiating on this matter."

Regarding the issue of repatriating laundered money, he said that it is a political commitment of the interim government.

"The international community is also now under pressure to act. Major media outlets such as The Financial Times, The Times of London, and Al Jazeera are publishing extensive articles about Bangladesh's illicit money laundering cases. More reports will follow," he added.

The BB governor also provided details about the newly launched CEC at PKSF, under which the foundation will provide bank loan guarantees to partner microfinance institutions (MFIs) through a reserve fund of Tk240 crore.

"A one-time 0.5% commission will apply for each guarantee. This initiative will make it easier for small businesses to secure loans from formal financial institutions," he added.

Supported by the ADB and the interim government, the scheme aims to boost access to finance for micro-entrepreneurs across Bangladesh.

Mansur concluded by urging financial institutions to enhance financial literacy nationwide.

"Every school should be partnered with a bank to educate students on basic financial skills," he emphasized, calling for a long-term investment in national economic awareness.

Caption: Copper price drops as raw metal excluded form 50% US tariff

Caption: Copper price drops as raw metal excluded form 50% US tariff

Caption: EU car industry sees relief - and pain - in US trade deal

Caption: EU car industry sees relief - and pain - in US trade deal